to Empower Female Entrepreneurs

Visa and CIB launch Global “She’s Next” Grant Competition in Egypt

- Egypt’s women business owners are invited to apply for a grant worth total ofUSD 30,000, a tailored training program and access to She’s Next Club networking and mentoring opportunities. Applications are open until October 26.

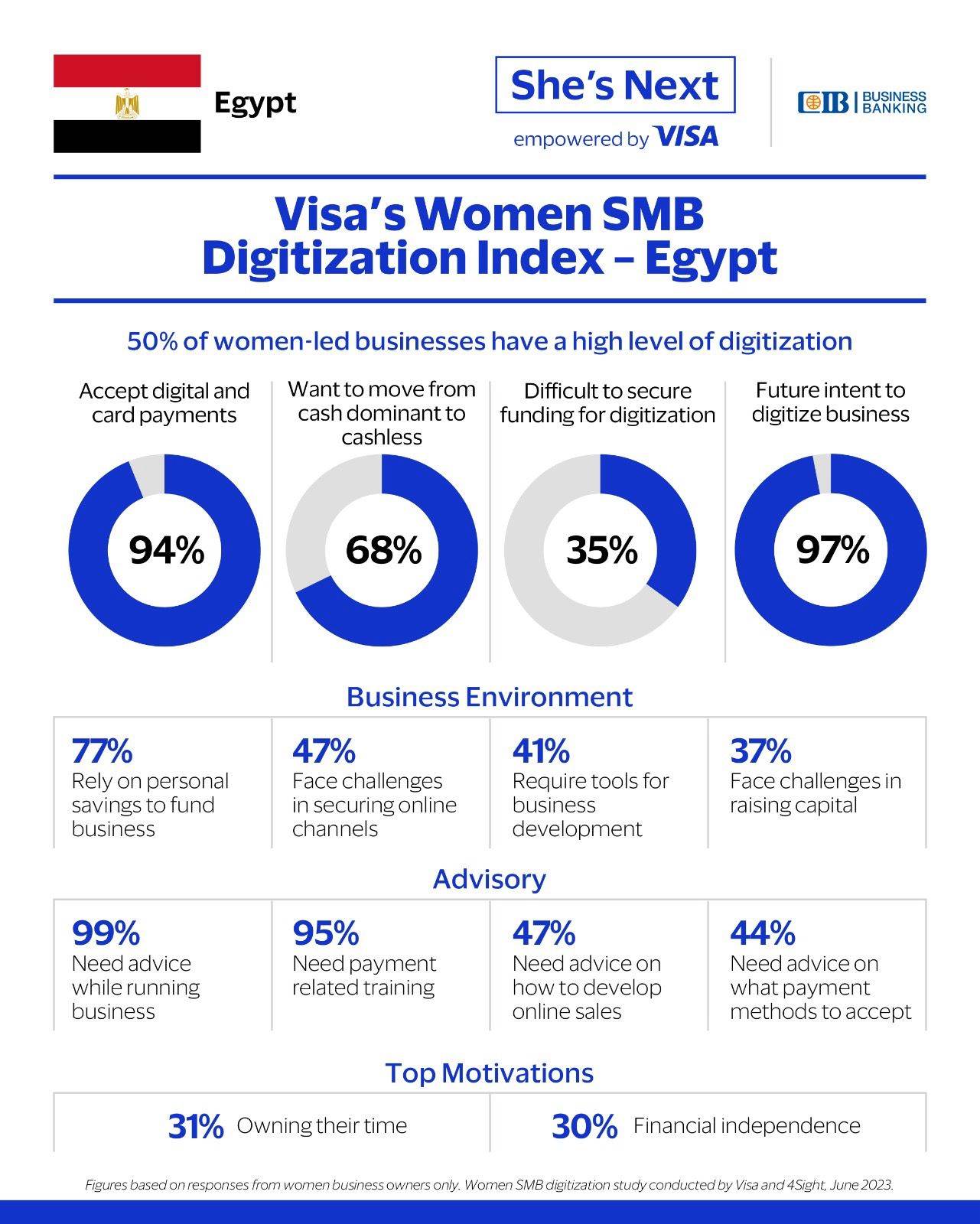

As part of the initiative, Visa and CIB conducted a survey revealing significant findings:

- Funding is a challenge for Egypt’s women-led businesses, with 77% dipping into personal savings.

- 95% of women-led businesses are interested in payment related training.

- Leveraging digitalization to transition to a cashless business is a huge opportunity for 68% women entrepreneurs.

Women-led businesses in Egypt are faced with challenges when it comes to funding, digitalization and seeking advisory, according to a survey of women entrepreneurs, by Visa, the world’s leader in digital payments.

The survey follows Visa’s endeavor to empower women entrepreneurs in the country by bringing its global She’s Next grant program to Egypt for the third time, in partnership with Commercial International Bank Egypt (CIB).

She’s next, empowered by Visa, is a global advocacy program that aims to support women-owned small businesses through funding, training, and mentorship. Until October 26, women entrepreneurs from all industries and sectors in Egypt can apply to She's Next for a chance to be one of three winners to receive a grant of USD 10,000 each, in addition to the monetary prize, five finalists will receive a one year mentorship program and the top twenty applicants will receive one year capacity building program from the USAID.

She’s Next finds relevance in Egypt, where women entrepreneurs are challenged with finding a support system and a role model/mentor to help them grow their business.

Malak El Baba, Country Manager for Egypt, Visa, commented: “We're proud to bring our successful ‘She's Next’ global program to Egypt, in partnership with Commercial International Bank. Women entrepreneurs face unique challenges such as limited access to capital, lack of mentorship and dealing with gender stereotyping concerns where they are considered less capable of handling high-pressure situations. Access to these factors along with a robust digital infrastructure is critical for women entrepreneurs to flourish and scale up their businesses. She’s Next underscores this vital digitalization shift, embraces the potential of women entrepreneurs, and enables them to thrive with support and innovation.”

Hany El Dieb, Head of SME Business at CIB said: “Through our partnership with Visa, the She’s Next initiative is unlocking the potential of female entrepreneurs, and is already supporting capable, ambitious women in achieving their goals. We are very proud of the initiative which falls in line with CIB strategy to support small- and medium-sized enterprises and empowering talented women entrepreneurs to take their businesses to the next level and creating new opportunities across our community through tailored financial and non- financial services”.

The survey of women entrepreneurs in Egypt revealed key aspects of their entrepreneurial journey, and identified themes that would drive empowerment. These themes are as follows:

A Challenging Business Environment

Women in Egypt are keen on beginning their business, citing owning their time (31%) and financial independence (30%) as top motivations. However, these entrepreneurs state funding is a serious challenge while running their businesses. Visa’s survey finds that 77% of women dip into their personal savings to fund their business, while 45% respondents rely on friends and family.

Advice from fellow entrepreneurs

Female entrepreneurs in Egypt are eager to learn from their peers, according to Visa’s survey. Nearly 99% respondents stated that they need advice, with many women entrepreneurs wanting specific assistance on overcoming problems while running their business (50%), developing online sales (47%), and building a team of employees (33%).

The Visa survey also found businesswomen are excited about building online sales, with 95% women wanting payment related training. A section of women (44%) seek advice on the types of payments accepted from customers, while more common topics for workshops included business development through digital marketing (29%), inspiring women to be confident (27%), and promoting business through social media (27%).

Digitalization, an opportunity to grow

She's Next is part of Visa’s efforts to support digitalization of women-owned businesses and features the launch of Visa’s first Women SMB Digitalization Index. The Index scores businesses based on 5 indicators: online presence, digital payments, payment security, customer engagement, and customer retention.

As a historically cash dominant market, the survey found that 7 in 10 women entrepreneurs claim to be digitally savvy, with 97% respondents having plans to digitalize their business focusing on AI and automation, digital marketing, analytics tools to generate insights, training leadership, andsoftware implementation. The survey also found that women entrepreneurs wanted to leverage digitalization to transition to a cashless business, as over one-third respondents (35%) found it challenging to secure funding for digitalization.

Being familiar with the cyber threat landscape, 76% women entrepreneurs use both cash and cashless modes of payment, with digital payments taking precedence over cash in online and offline selling platforms.

Since 2020, Visa has invested around $3M in over 250 grants and coaching for women SMB owners through the She’s Next grant program globally including in US, Canada, India, Ireland, Ukraine, Kazakhstan, Saudi Arabia, UAE, Egypt and Morocco.

To learn more and apply for Visa She's Next Grant Program, applicants must submit a short application form with details about their business and digital presence.