EIB Group provided €36.6 billion to EU cohesion regions in 2021

EIB lending in the European Union’s poorer regions helped reduce the economic impact of the COVID-19 pandemic.

In 2021 the EIB Group provided €36.6 billion of finance to EU cohesion regions, representing 46.8% of the Group’s total financing volumes in 2021.

Climate and cohesion goals are interlinked and mutually reinforce each other, Lending in support of EU cohesion policy by the European Investment Bank Group (EIB Group) helped contain the economic fallout from the pandemic and could now help counter some of the short-term fallout from the war in Ukraine, says a new report, EIB Group Activities in EU Cohesion Regions.

Promoting cohesion has been a core mission of the Bank since its foundation in 1958, Over the course of the European Union’s last long-term budget, between 2014 and 2020, the EIB Group supported investments worth around €630 billion in poorer, “cohesion” regions, equivalent to about 16% of the European Union’s gross domestic product.

According to the report, the impact and long-term benefits of these investments go even further than containing immediate economic shocks. By 2040, the investments supported between 2014 and 2020 are expected to raise EU gross domestic product (GDP) by an estimated 4.7% above the baseline scenario, and lead to the creation of an additional 3.2 million jobs.

The report, which follows the new cohesion orientation that the Bank adopted last October, examines the activities of the EIB Group in cohesion regions in 2021 in terms of policy objectives, activity sectors, countries, contribution to the United Nations Sustainable Development Goals (SDGs) and sector-specific project results. It features case studies from across the European Union, outlines the economic and social challenges facing cohesion regions and reviews the macroeconomic impact of the Group’s support.

“In response to all the challenges facing the European Union and its Member States, the EU bank is increasing both its lending and advisory support for cohesion,” said EIB Vice-President Lilyana Pavlova.

“This report, the first of its kind, clearly shows that the EIB’s support for cohesion policy is making a positive difference for citizens and businesses, I hope that the report can also inspire policymakers and business leaders, showing how they can best use the EIB Group’s tools to help their communities thrive.”

European Investment Fund Chief Executive, Alain Godard, said: “We are delighted to publish this first report concerning our cohesion activities. With €16.8 billion worth of transactions signed in 2021, we have provided strong support to the SMEs located in the less developed regions of Europe. Cohesion is a key strategic priority for the EIF and, going forward, we have reinforced our commitment by dedicating a large part of our future activities to these areas.”

In 2021, the EIB Group provided €36.6 billion to projects in EIB cohesion regions. For the EIB, this represented 41.5% of its 2021 EU lending, well above the share of cohesion regions in the European Union’s economy (35% based on GDP). EIB lending supported projects worth €47.3 billion in cohesion regions.

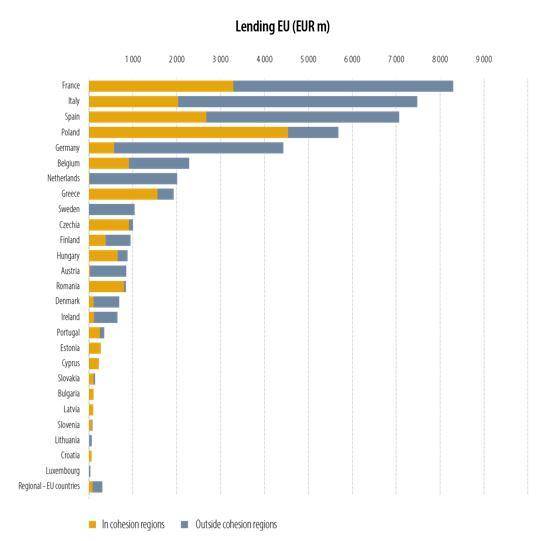

In terms of lending to cohesion regions, Poland obtained the most (€4.5 billion), followed by cohesion regions in France (€3.3 billion) and Spain (€2.7 billion). Relative to the size of their economies, Greece, the Czech Republic and Romania also benefited from high cohesion lending volumes with €1.6 billion, €0.9 billion and €0.8 billion, respectively.

Transactions signed by the EIF in 2021 totalled €16.8 billion and provided support to SMEs and other eligible final recipients located in cohesion regions in 25 of the EU’s 27 Member States. The support was mainly through debt/guarantee and equity financial instruments.

In absolute terms, the cohesion regions that are expected to benefit the most from EIF transactions signed in 2021 are in Portugal, Italy and Spain. Relative to GDP, however, EIF support for cohesion areas in 2021 is expected to be greater in Bulgaria and Croatia.